What happened to withholding benefits?

Surcharges are no longer used for the revised Form W-4. This change is intended to improve transparency, simplicity, and shape accuracy. In the past, the amount of retention was tied to the amount of personal exemption. Due to changes in legislation, you cannot currently claim an exemption from personal or dependents.

Are all employees required to complete a new Form W-4?

Not. Employees who completed a W-4 in any year prior to 2020 are not required to submit a new form simply because of a design change. Employers will continue to calculate retention based on information from the employee's most recent Form W-4.

My tax situation is simple. Do I have to follow all the steps?

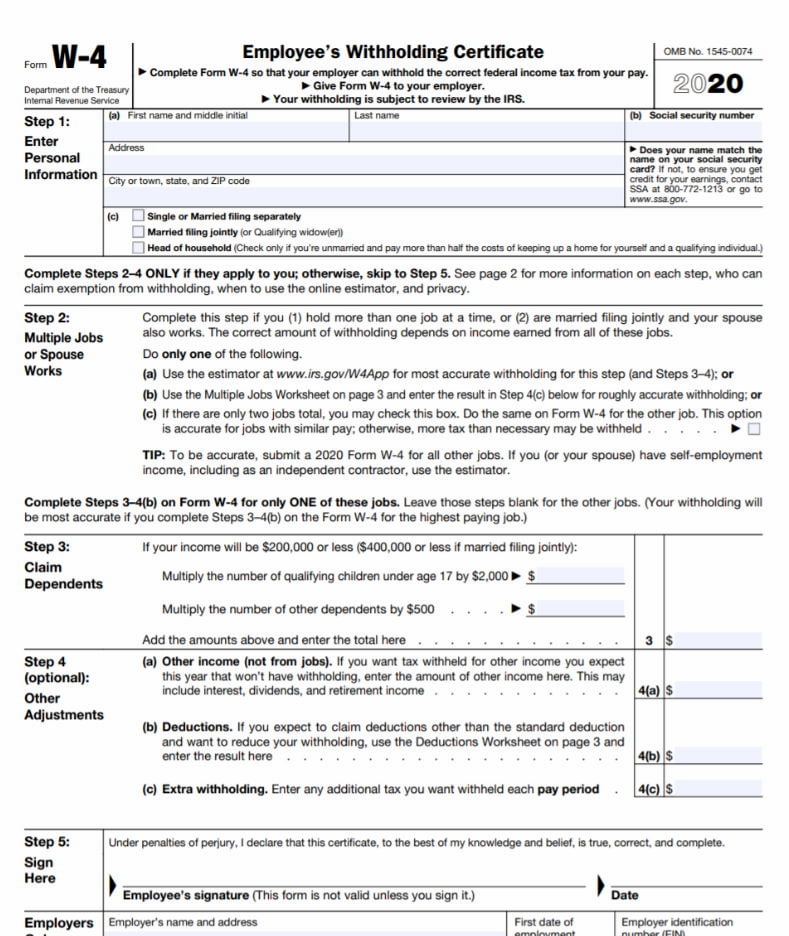

Not. The form is divided into 5 steps. All employees only need two steps: Step 1, where you enter personal information such as your name and registration status, and Step 5, where you sign the form. Follow steps 2-4 only if they apply to you. This will make the withholding you withhold more closely match your liability.

What happens if I only fill out step 1 and then sign the form?

Your withholdings will be calculated based on the standard tax rates and tax rates of your filing status, without any other adjustments.

When should I increase my retention rate?

Usually, you should increase your retention size if:

you are doing more than one job at the same time or you and your spouse have a job (step 2) or

you have income from sources other than work or self-employment that cannot be withheld (step 4 (a)).

If you do not change the withholding amount for these situations, you will most likely have to pay additional tax when you file your tax return, and you may have to pay a penalty. For income from sources other than jobs, you can pay estimated tax instead of backup withholding.

When should I decrease my retention rate?

Usually, you should reduce your hold size if:

you are eligible for tax benefits such as a Child Tax Credit or Credit for Other Dependents (Step 3), and / or

you are eligible for deductions other than the base standard deduction, such as itemized deductions, IRA withholding contributions, or student loan interest deductions (step 4 (b)).

I would like to receive a refund when I file my tax return. How do I fill out an updated W-4?

The updated Form W-4 makes it easier to align withholding taxes with your tax liability. But if you would rather have more tax withheld from each paycheck than necessary, you will get that money back as a refund when you file your tax return (keep in mind that you do not receive interest on the overpaid amount). The easiest way to increase your deduction is to enter in step 4 (c) the additional amount that you would like your employer to deduct from each paycheck. Please note that even if no income tax is withheld from your paycheck, you may still be eligible for a refund if you are eligible for tax benefits such as Earned Income Credit, Child Supplemental Tax Credit, or American Opportunity Credit.

Why do I need to consider multiple assignments (step 2)? I've never done this before.

Tax rates increase as income rises, and only one standard deduction can be claimed on each tax return, regardless of the number of jobs. Thus, if you have multiple jobs at the same time, or are married and are applying together, and you and your spouse are employed, you should generally deduct more money from the combined pay for all jobs than if each job was considered separately. ... When filing your tax return, you need to make adjustments to your withholding income to avoid additional taxes and possibly penalties. This has all been true over the years; it has not changed with the recent changes in tax legislation. The old form W-4 allowed for multiple assignments using detailed instructions and worksheets that many employees might overlook. Step 2 of the revised Form W-4 lists three different options from which you must select to make the necessary adjustments to the withholding. Please note that to be accurate, you must submit a 2020 Form W-4 for all of these jobs.

Which option in step 2 should I use to track multiple of my jobs? What is most accurate? What if I don't want to tell my employer on a W-4 that I have a second job?

Step 2 allows you to choose from three options, offering a trade-off between accuracy, privacy, and ease of use:

Step 2 (a): For maximum accuracy and confidentiality, use the Withholding Estimator at www.irs.gov/W4app. Typically, you will be asked to enter an additional withholding amount in step 4 (c). Although you will need to know the approximate amount to be paid for each job, you will enter the additional withholding amount in step 4 (c) of your Form W-4 for only one of the jobs. If the pay for any of the jobs changes significantly, you will need to use the Withholding Estimator again and submit a new Form W-4 to change the amount in step 4 (c) to obtain an accurate withholding.

Step 2 (b): If you do not have access to the Tax Withholding Estimator, but you want to have an approximate accurate withholding and maintain confidentiality, you can use the Multi-Work Worksheet on page 3. You will be prompted for an additional amount to withhold. in step 4 (c). Although you will need to know the approximate amount to be paid for each job, you will enter the additional withholding amount in step 4 (c) of your Form W-4 for only one of the jobs. If a change in pay for any of the jobs changes the amount of the backup withholding in the look-up table used with this sheet, you will need to submit a new Form W-4 to change the amount in step 4 (c) in order to obtain an accurate withholding. If you (and your spouse) have only two jobs, and the pay for the higher-paying job is more than double the pay for the lower-paying job, this option is usually more accurate than choosing step 2 (c). If the pay for each job is more similar, choosing step 2 (c) is more accurate than choosing step 2 (b).

Step 2 (c): If you (and your spouse) have only two jobs at the same time, you can check the box in Step 2 (c) of your Form W-4 for both jobs. That is, to use this option, you must complete a Form W-4 for each assignment with the checkbox checked in step 2 (c). The standard deduction and tax brackets will be cut in half for each job to calculate the deduction. You will not need to provide a new Form W-4 to record changes in pay at any job. This option is suitable for work with a similar payment; otherwise, more tax may be withheld from your wages than necessary. This additional amount will be the greater, the greater the difference in payment between the two jobs.

The instructions above for step 3 say that in households with multiple jobs, adjustments in steps 3-4b should only be made in one form, and that retention is most accurate if adjustments are made in W-4 for the highest paying job. But what happens if the pay for the two jobs is relatively the same, or if changes in pay over time result in the other job becoming the highest paid?

In general, making these adjustments to the W-4 for the highest paying job improves accuracy. However, if jobs in your household are paid about the same, or if changes in wages, which are the highest paid jobs, change over time, it is less important which W-4 form is used to adjust.

What if I do not want to report the amount of my non-work income, such as investment income or retirement income, on my Form W-4 (Step 4 (a))?

You are not required to withhold non-work income tax from your paycheck. Instead, you can pay estimated tax on that income using Form 1040-ES Estimated Tax for Individuals. However, if you want to use Form W-4 to withhold tax on this income from your paycheck, and you do not want to report this income directly in step 4 (a), you have several options. First, you can use the Tax Withholding Estimator at www.irs.gov/W4app. An appraiser will help you calculate the additional tax to be withheld from your paycheck. You will then enter this amount in step 4 (c) without reporting income to your employer. Second, you can determine the amount of backup withholding required to pay tax on your other income (for example, using Publication 505), divide this amount by the number of due dates in the year, and enter the result in Step 4 (c). Third, if this is the only job in your household, you can check step 2 (c), which will increase your retention and significantly reduce your salary. The amount of this backup withholding varies depending on the taxpayer and ranges from $ 0 to $ 20,000 per year, and you may not know how much more is withheld. Also, whether this backup withholding is too small or too large - and will result in a balance or refund owed - depends on the amount of your non-work income.

Do I have to pay new hires after 2019 to use the updated form?

Yes. All new hires paid after 2019 must use the updated form. Likewise, any other employee who wishes to change the amount of retention must use the updated form.

How do I treat new employees who received their first salary after 2019 who did not submit a W-4?

New employees who receive their first salary after 2019 and do not submit a Form W-4 will be treated as a single submitter without any other adjustments. This means that the standard withholding of one submitter without any other entries will be taken into account when determining the retention. This regime also usually applies to employees who have previously worked for you who were re-hired in 2020 and did not submit a new W-4.

What about employees with pre-2020 paychecks who want to adjust deductions from their pay from January 1, 2020 or later?

Employees must use the updated form.

Will there be an adjustment for non-resident foreigners?

Yes. The IRS will provide guidance in Publication 15-T 2020, Federal Income Tax Withholding Methods, on the additional amounts that must be added to wages to determine the withholding for non-resident aliens. In addition, non-resident foreign employees must continue to follow the specific instructions in Notice 1392 when completing their Forms W-4.