Introduction

For information on any additional changes in 2019 tax legislation or any other developments affecting Form 1040 or 1040-SR or instructions, go to IRS.gov/Form1040.

These instructions cover Forms 1040 and 1040-SR.

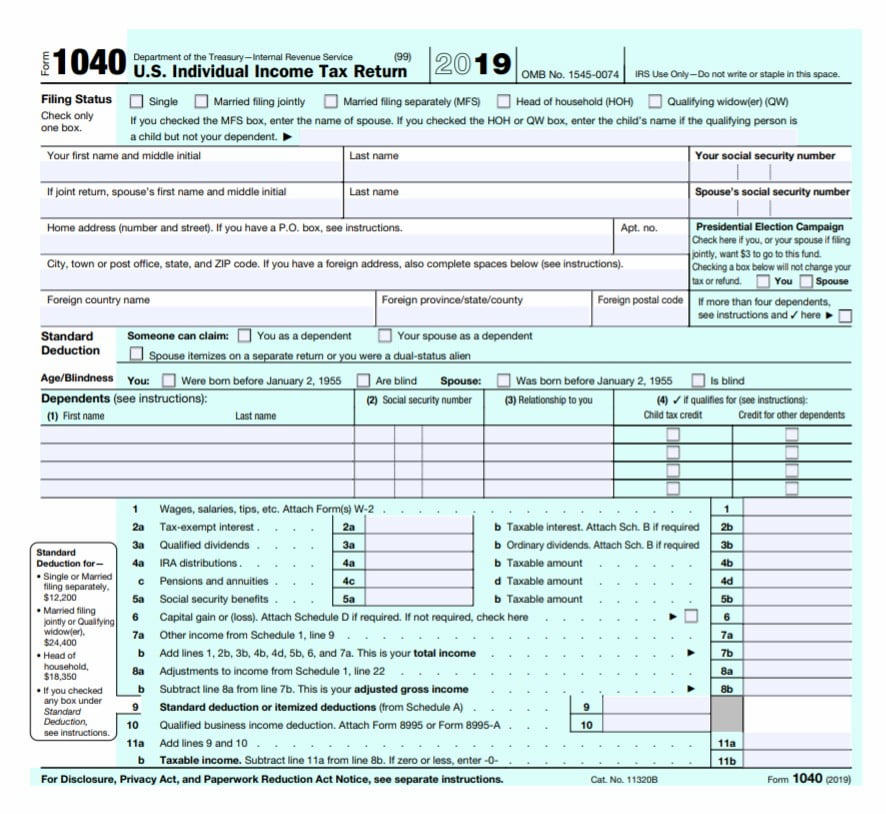

Fewer numbered schedules. This year there are only 3 numbered schedules instead of 6. Tables 2 and 4 have been combined into Table 2, and this is where you will report any additional taxes you may owe. Tables 3 and 5 have been merged into Table 3, and this is where you must report any credits you did not request on Form 1040 or 1040-SR.

IRA and retirement reporting. You will now report your IRA payments, pensions, and annuities on separate lines. Use lines 4a and 4b on Form 1040 or 1040-SR to indicate the IRA allocation and taxable amount. Use new lines 4c and 4d to indicate pensions and annual benefits, as well as tax. See the instructions for lines 4a and 4b and lines 4c and 4d below.

The capital gain or (loss) is now reported on line 6. In 2018, the capital gain or (loss) was recorded in Schedule 1 (Form 1040), line 13. In 2019, this will be shown on Form 1040 or 1040-SR, line 6.

Payment of joint liability for health insurance. In 2019, you no longer need to pay split liability or complete Form 8965 if you do not have minimum primary health insurance for part or all of 2019. The "Annual Medical Insurance or Tax Exemption" field has been removed from Form 1040.

The standard deduction has been increased. For 2019, the standard deduction amount has been increased for all applicants. The amounts are as follows:

- Separate filing of a bachelor or married - $ 12,200.

- Widow (widow), married or eligible - $ 24,400.

- The head of the family - $ 18,350.

Deduction of qualified business income. The simplified table for calculating the deduction from qualified business income is now Form 8995, Simplified Calculation of Qualified Business Income Deduction. If you are not eligible to file Form 8995, use Form 8995-A, Qualified Business Income Withholding. For more information, see the instructions for each form.

The amount of exemption from the Alternative Minimum Tax (AMT) has been increased. AMT waiver increases to $ 71,700 ($ 111,700 if filing married or eligible widow; $ 55,850 if filing separately). The income level at which the AMT exemption begins to phase out has increased to $ 510,300 ($ 1,020,600 if married or widowed).

Qualified investment opportunity. If you have had a qualifying investment in a qualifying opportunity fund at any time during the year, you must attach Form 8997, Initial and Annual Statement of Investments in the Qualifying Opportunity Fund (QOF) to your declaration. For more information, see Form 8997 and its instructions.

Virtual currency. If you were involved in a virtual currency transaction in 2019, you will need to submit Attachment 1. For more information, see Attachment 1 instructions.

E-mail address. An optional field has been added to Forms 1040 and 1040-SR for your email address.

Medicaid Waiver Payments. Changes have been made to how Medicaid exemption payments are processed for earned income offset purposes. See Instructions for line 18a.

Extended tax provisions. Recent legislation has expanded the scope of some of the tax breaks that expired at the end of 2017. These tax credits include the following.

- Tuition Deduction and Fees.

- Withholding mortgage insurance premiums.

- Lending to non-state energy property.

- Loan for refueling a car with alternative fuel.

- Indian employment loan.

If you are eligible for one or more of these benefits in 2019, you can claim them on your 2019 return. If you are eligible for one or more of these benefits in tax year 2018, you will need to file an amended return, Form 1040-X, to claim them. See IRS.gov/Form1040X for more information on amending your tax return.

Tax relief in case of natural disasters. Disaster-related tax credits have been introduced for those affected by some federally declared disasters. The tax credits provided by this benefit include the following.

- Increased standard deduction based on your qualified disaster losses. See Instructions for line 9 and instructions for Appendix A for information on qualifications and calculations of the increased standard deduction.

- Choosing to use your 2018 earned income to calculate the 2019 Earned Income Loan. See Instructions for line 18a for more information on these choices.

- Choosing to use your 2018 earned income to calculate the 2019 additional child tax credit. See Instructions for line 18b and instructions for Schedule 8812 for more information on these elections.